Pengaruh Gross Profit Margin, Quick Ratio, dan Debt To Asset Ratio Terhadap Nilai Perusahaan (Studi Empiris pada Perusahaan Manufaktur Sektor Industri Barang Konsumsi SUB Sektor Makanan dan Minuman Yang Terdaftar di Bursa Efek Indonesia Periode Tahun 2

Keywords:

Gross Profit Margin, Quick Ratio, Debt to Asset Ratio, Company ValueAbstract

This research examines empirically the effect of Gross Profit Margin (GPM), Quick Ratio (QR), and Debt to Asset Ratio (DAR) to Company Values in manufacturing companiesin the consumer goods industry sector, food and beverage sub sector for the period 2020 – 2022. The ones in this research are all finance reports of food and baverage sub sector manufacturing companies that passed the sampling criteria for 3 years from 2020 – 2022. The sampling method was carried out using the purposive sampling method. The type of data analysis used in this research is quantitative data, with descriptive statistical analysis, classical assumption test, multiple linier regression, coefficient of determination and multiple correlation, partial test (T test) and simultaneous test (F test) using the SPSS version 16 application. This research shows that Gross Profit Margin (GPM), Quick Ratio (QR) and Debt to Asset Ratio (DAR) have a positive effect on Company alue in Manufacturing Companies in the Consumer Goods Industry sector, food and baverage sub-sector for period 2020 – 2022. Based on simultaneous testing, it states that Gross Profit Margin (GPM), Quick Ratio (QR) and Debt to Asset Ratio (DAR) simultaneously have a significant effect on Company Value in Manufacturing Companies in the Consumer Goods Industrial sector, food and beverage sub-sector for the period 2020 – 2022.

References

Agustinus, E. (2021). Pengaruh return on asset dan debt to equity ratio terhadap pertumbuhan laba pada perusahaan sub sektor makanan dan minuman yang tercatat di BEI periode 2015–2019. Jurnal Arastirma, 1(2), 239.

Ayem, & Nugroho. (2016). Pengaruh profitabilitas, struktur modal, kebijakan dividen, dan keputusan investasi terhadap nilai perusahaan. Jurnal Akuntansi, 4(1).

Dahlena, M. (2017). Pengaruh likuiditas, risiko bisnis dan profitabilitas terhadap struktur modal pada perusahaan textile & garment di BEI. Jurnal Riset Akuntansi & Bisnis, 17(2). Medan: Universitas Muslim Nusantara.

Dewi, & Silvia. (2021). Pengaruh gross profit margin, return on equity terhadap pertumbuhan laba (Studi kasus pada perusahaan sub sektor pertambangan batu bara yang terdaftar di BEI periode 2017–2019). Journal of Accounting Taxing and Auditing (JATA), 2(2).

Hidayat, R. (2018). Pengaruh debt to equity ratio, debt to asset ratio, dan profitabilitas terhadap nilai perusahaan food and beverage yang terdaftar di Bursa Efek Indonesia. Akuntansi dan Keuangan, 1(2), 27–36.

Made, & Suaryana, A. (2016). Pengaruh debt to assets ratio, dividend payout ratio, dan return on assets terhadap nilai perusahaan. Jurnal Akuntansi, 17(3). Bali: Universitas Udayana.

Meythi. (2013). Rasio keuangan terbaik untuk memprediksi nilai perusahaan. Jurnal Keuangan dan Perbankan, 17(2), 200–210.

Nurmalasari, T. (2012). Analisis pengaruh rasio keuangan terhadap perubahan laba pada perusahaan manufaktur terdaftar di BEI. Jurnal Ekonomi Universitas Gunadarma.

Nurminda, A., Daennes, I., & Annisa, N. (2017). Pengaruh leverage, profitabilitas, dan ukuran perusahaan terhadap nilai perusahaan: Studi pada perusahaan manufaktur sub sektor barang dan konsumsi yang terdaftar di Bursa Efek Indonesia periode 2012–2015. E-Prosiding Manajemen, 1(4), 542–549.

Ridwan, & Fajar. (2020). Analisis pertumbuhan penjualan, gross profit margin, dan shrinkage terhadap pertumbuhan laba. Jurnal Sain Manajemen, 2(2), 73–83.

Suryaningsih, D., Irwansyah, & Ginting, L. Y. (2020). Pengaruh profitabilitas, likuiditas, leverage, dan aktivitas terhadap nilai perusahaan. Jurnal Ilmu Akuntansi, 2.

Downloads

Published

How to Cite

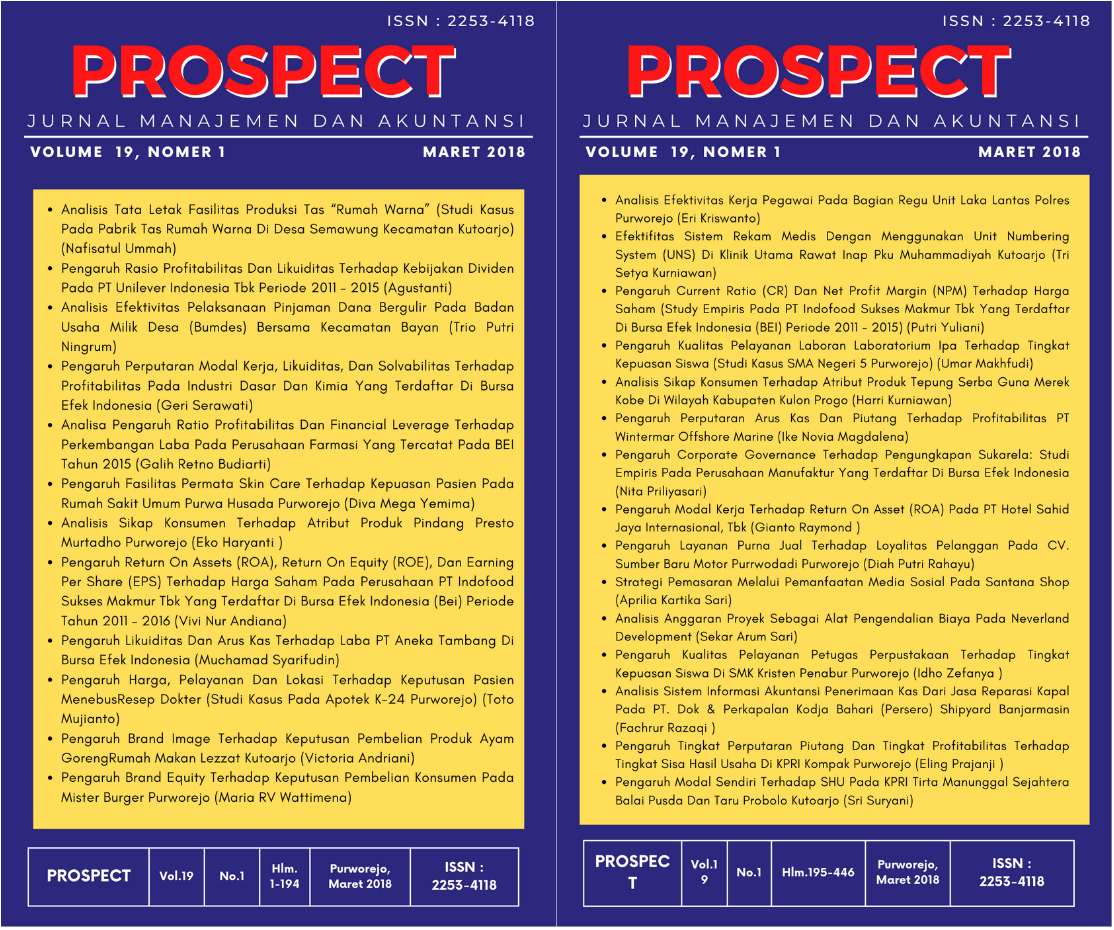

Issue

Section

License

Copyright (c) 2024 Prospect : Jurnal Manajemen dan Akuntansi

This work is licensed under a Creative Commons Attribution-ShareAlike 4.0 International License.