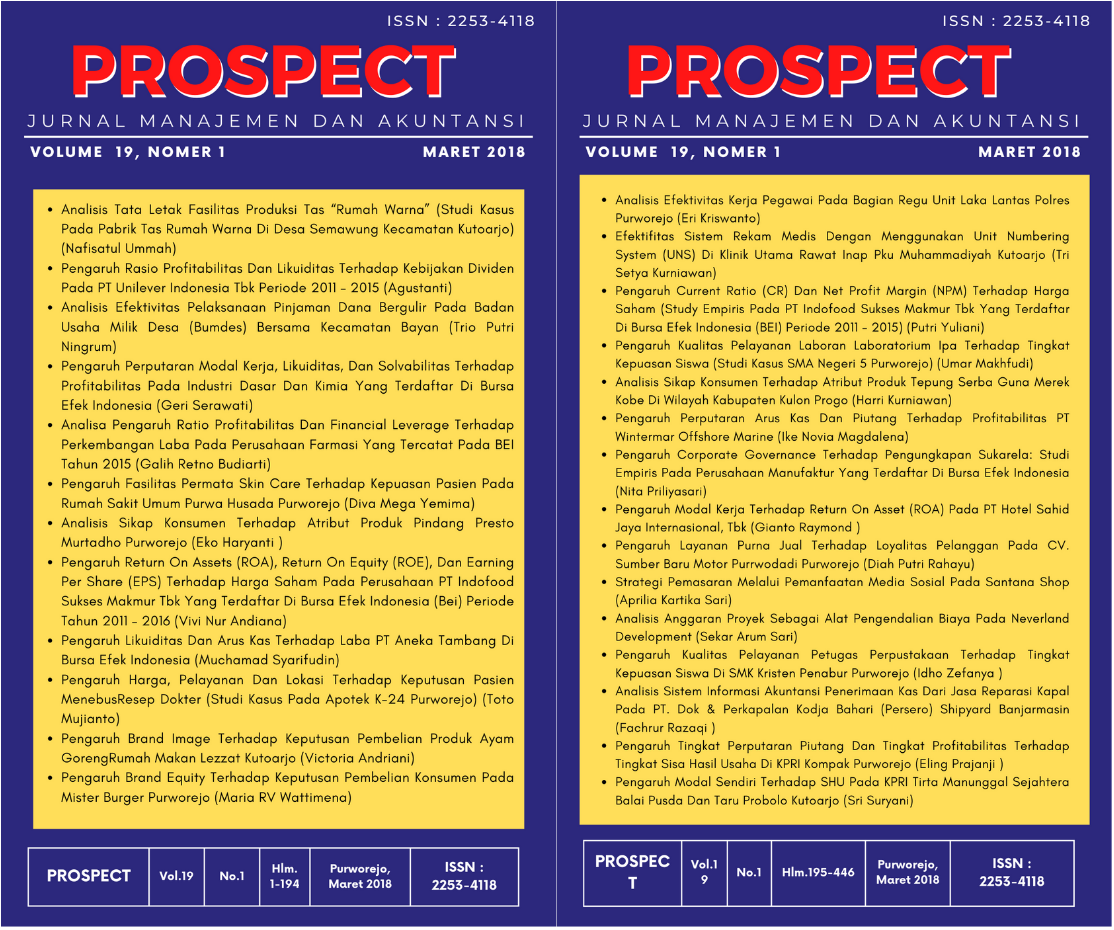

PENGARUH PERPUTARAN MODAL KERJA, LIKUIDITAS, DAN SOLVABILITAS TERHADAP PROFITABILITAS PADA INDUSTRI DASAR DAN KIMIA YANG TERDAFTAR DI BURSA EFEK INDONESIA

Keywords:

Working Capital Turnover, Debt to Equity Ratio, Current Ratio, Return on AssetsAbstract

The purpose of this study is to find out how big the influence of working capital turnover, liquidity, and solvency on profitability in basic and chemical industries listed on the BEI. The data used in this study consists of Quantitative data, ie data in the form of figures derived from corporate financial report data into the research sample, the accounting period December 31, 2015, and routinely published every year in the form of Indonesian Capital Market Directory (ICMD) which accessed through www.idx.co.id in the form of financial report data of compan ies incorporated in the cement sub-sector listed on the BEI period 2015.This research data is processed using the program SPSS 17.0. The research findings show that: partially Working Capital Turnover (WCT) does not have a very significant effect on Return On Investment (ROI), the significant value obtained 83.2% greater than 5%. Partially Current Ratio (CR) has no significant effecton Return On Investmen (ROI), because the level of significance obtained is greater than the standard used is 63.9% of 5%. Partially Debt to Equity Ratio (DER) has no significant effect on Return On Investment (ROI), because the level of significance obtained is greater than the standard usedie 27.9% from 5%. From F test, the result of Working Capital Turnover, Current Ratio and Solvency (Debt to Equity Ratio) simultaneously have no significant influence on profitability (Return on Investment). The significant level obtained is greater than the standard used ie 33.1% of 5%.References

Brigham, F. Eugene, dan Houston, F. Joel. 2001. Manajemen Keuangan. Jakarta: Erlangga.Dwi Prastowo dan Rifka Juliaty.2008. Analisis Laporan Keuangan: Konsep dan Aplikasi (Edisi Kedua). Yogyakarta : UPP STIM YKPNFahmi, Irham.2011. Analisis Laporan Keuangan. Lampulo: ALFABETAIkatan Akuntansi Indonesia.2009. Standar Akuntansi Keuangan.Jakarata: Salemba EmpatJumingan. 2016. Analisis Laporan Keuangan,Cetakan Pertama.Jakarta: PT Bumi Aksara.

Kasmir. 2008. Analisis Laporan Keuangan. Jakarta: Rajawali Pers.Kasmir. 2010. Analisis Laporan Keuangan, Edisi Ketiga. Jakarta: Rajawali Pers.Munawir.2010. Analisa Laporan Keuangan. Yogyakarta: LibertyPriyatno, Dwi. 2010. Paham Analisa Statistik Data dengan SPSS. MediaKom: Jakarta.Sawir, Agnes. 2001. Analisis Kinerja Keuangan dan Perencanaan Keuangan Perusahaan. Jakarta: PT Gramedia Pustaka Utama.Sofyan Syafri Harahap.2009.Teori Kritis Laporan Keuangan.Jakarta:Bumi AksaraSofyan Syafri Harahap.2011. Analisa Kritis atas Laporan Keuangan. Edisi ke-5. Jakarta: Raja Grafindo PersadaSugiyono,2008. Metode Penelitian Bisnis. Jakarta: AlfabetSunariyah.2000.Pengantar Pengetahuan Pasar Modal. UPP APM YKPN. Yogyakarta.Suwardjono.2008. Akuntansi Suatu Pengantar. Jakarta: Salemba EmpatVan Horne, James C & John M. Wachowicz,JR.2009. Prinsip-Prinsip Manajemen Keuangan. Jakarta: Salemba Empatwww.idx.co.id inclusion. In 3rd Borobudur International Symposium on Humanities and Social Science 2021 (BIS-HSS 2021) (pp. 942–947). Atlantis Press.

Siyami, N., & Rusmiyatun, R. (2022). Determinan financial performance di era Society 5.0 (Dari perspektif pemahaman literasi keuangan, literasi teknologi, finansial teknologi dan inklusi keuangan). Syntax Literate; Jurnal Ilmiah Indonesia, 7(11), 15733–15752.

Probowati, A. (2011). Strategi pemilihan supplier dalam Supply Chain Management pada bisnis ritel. SEGMEN Jurnal Manajemen dan Bisnis, 7(1).

Dyah, I. A., Saraswatih, R. P., & Probowati, A. (2021). DECISION ON THE USE OF CLOSE CIRCUIT TELEVISION (CCTV) IN TERMS OF SECURITY, CRIME PREVENTION AND TECHNOLOGY UTILIZATION ( Study on CCTV users in Surakarta city ). International Journal of Economics, Business and Accounting Research (IJEBAR), 5(4). https://doi.org/10.29040/ijebar.v5i4.8794

Nova Ari Pangesti, Ahmad Muzaki, Hesti Respatiningsih, Dita Ayu Nur Saputri, & Nani Wahyuni. (2024). PMP peningkatan kapasitas pemasaran usaha batik jumputan pada kelompok disabilitas Desa Bragolan, Kabupaten Purworejo. JURPIKAT (Jurnal Pengabdian Kepada Masyarakat), 5(1), 70–85. https://doi.org/10.37339/jurpikat.v5i1.1577

Rusmiyatun, R. (2021). Evaluasi proses penganggaran dana bantuan operasional sekolah di Kabupaten Purworejo. SEGMEN Jurnal Manajemen dan Bisnis, 17(2).

Respatiningsih, H. (2021, March). The impact of E-Commerce on the marketing performance of MSMEs during the Covid-19 pandemic mediated by competitive advantage. In The 3rd International Conference on Banking, Accounting, Management and Economics (ICOBAME 2020) (pp. 166–169). Atlantis Press.DOI 10.2991/aebmr.k.210311.032

Respatiningsih, H. (2011). Manajemen Kredit Usaha Mikro Kecil dan Menengah (UMKM). SEGMEN Jurnal Manajemen Dan Bisnis, 7(1), 31-44.

Lestari, T. W., Sucipto, A., & Respatiningsih, H. (2023, December). Implementation Of Green Business Ecoprint Industry In Purworejo Regency. In International Conference On Digital Advanced Tourism Management And Technology (Vol. 1, No. 1, pp. 126-131).

Wakhdan, W., Sucipo, A., & Siyami, N. (2023). COMPETENCE AND LITERACY AS A MODEL FOR THE DEVELOPMENT OF COMPETITIVE MILLENNIAL FARMERS IN PURWOREJO REGENCY. Jurnal Scientia, 12(03), 2658-2664. https://doi.org/10.58471/scientia.v12i03.1604

Downloads

Published

How to Cite

Issue

Section

License

Copyright (c) 2024 PROSPECT

This work is licensed under a Creative Commons Attribution-ShareAlike 4.0 International License.