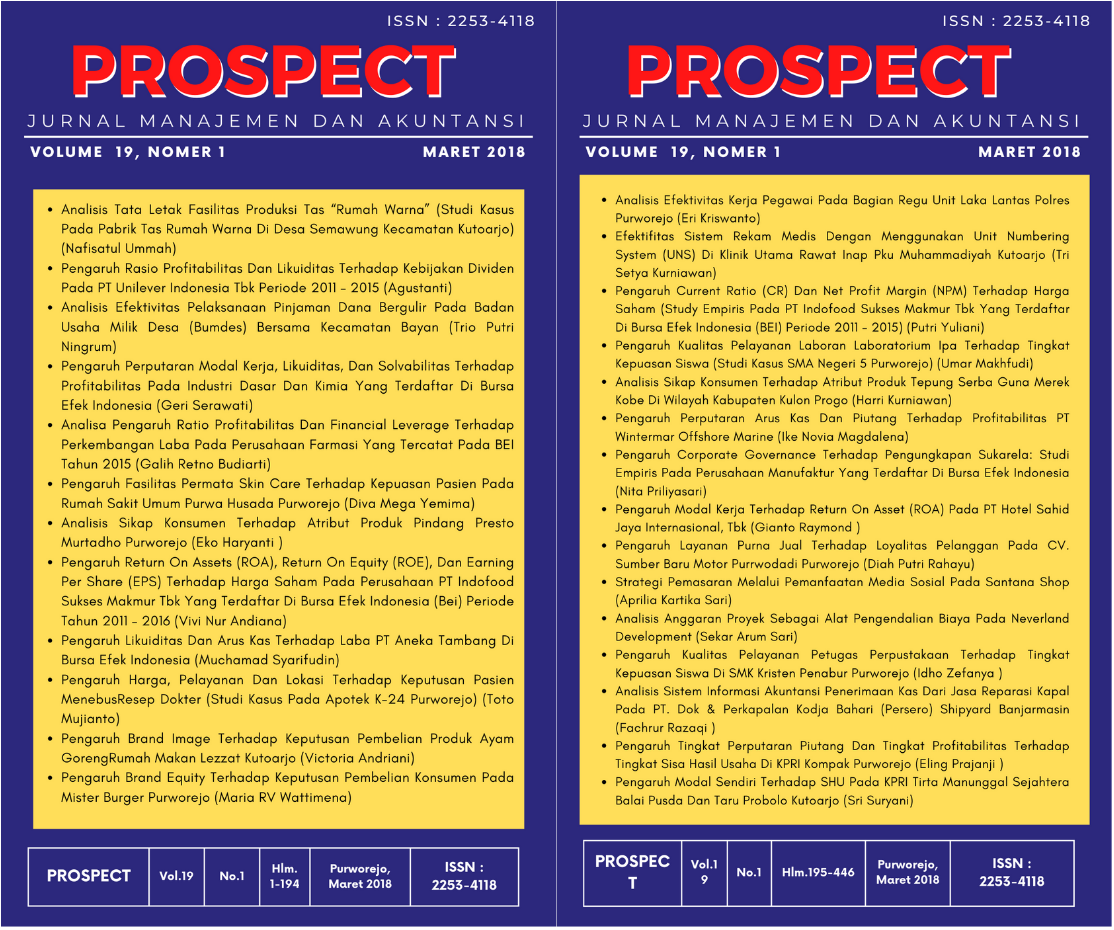

PENGARUH GOOD CORPORATE GOVERNANCE (GCG)TERHADAP KINERJA KEUANGAN PERUSAHAAN

Studi Empiris Per usahaan Manufaktur Sub Sektor Farmasi yang terdaftar Di Bursa Efek Indonesia Tahun 2017-2018

Keywords:

Institutional Ownership, Managerial Ownership, Company Financial PerformanceAbstract

Economic developments in the business world are very fast and increasingly strong, resulting in demands for companies to continue to carry out various kinds of innovations to improve performance and expand company businesses so that they are able to compete and survive in the business world. Research with the title "The Influence of Good Corporate Governance (GCG) on Company Financial Performance”. This research uses a population of pharmaceutical sub-sector manufacturing companies listed on the Indonesia Stock Exchange (BEI) for the 2017-2018 period. The purpose of this research is to examine the influence of Institutional Ownership on Company Financial Performance, to examine the influence of Managerial Ownership on Company Financial Performance and to examine the influence of Institutional Ownership and Managerial Ownership on Company Financial Performance. The data sources used are secondary data and a purposive sampling method to determine the sample. will be used and produce a final sample of 10 manufacturing companies. After carrying out the sampling criteria, 6 companies were used as samples. The data in this research were analyzed using the SPSS program. The analysis used was descriptive analysis, classical assumption testing, statistical analysis and hypothesis testing. Based on the data analysis carried out, it was concluded that institutional ownership had a positive effect on financial performance, managerial ownership had no significant effect on financial performance, institutional ownership and managerial ownership had a positive effect on financial performance.

References

Arifani, Rizky. 2013. “Pengaruh Good Corporate Governance terhadap Kinerja Keuangan Perusahaan”. Business Accounting Review 3(1).Daniri, Mas Achmad. 2007. Good Corporate Governance: Konsep danPenerapannya dalam Konteks Indonesia, cetakan 1. Jakarta: PT RayIndonesia.Ermayanti, Dwi. 2009. Kinerja Keuangan Perusahaan. http://dwiermayanti.wordpress.com. Diakses tanggal 27 April 2010.Gunarsih, Tri. 2001. Corporate Governance: Struktur Kepemilikan, Kinerja dan Diversifikasi.Rancangan Proposal Disertasi. Yogyakarta: UGM.Hastuti, Theresia Dwi. 2005. Hubungan Antara Good Corporate Governance dan Struktur Kepemilikan dengan Kinerja Keuangan (Studi Kasus pada Perusahaan yang Listing di Bursa Efek Indonesia). Solo: Simposium Nasional Akuntansi VIII, IAI, 2005.Hidayat, R. 2015. “Pengaruh Good Corporate Governance dan Ukuran Perusahaan Terhadap Kinerja Keuangan Perusahaan (Studi Empiris pada Perusahaan Perbankan yang Terdaftar di BEI 2010-2013)”. 2(1), 1-15.Lestari, Yuni Tri., danNur Fadjrih. 2015. “Pengaruh Corporate Governance terhadap Kinerja Keuangan: Corporate Social Responsibility sebagai Variabel Intervening”. Jurnal Ilmu dan Riset Akuntansi 4(7).Martsila, Ika Surya dan Wahyu Meiranto. 2013. “Pengaruh Corporate GovernanceTerhadap Kinerja Keuangan Pada Prusahaan non finansial yang Terdaftardi Bursa Efek Indonesia (BEI).

Noviawan, R. A., dan Septiani, A. 2013. “Pengaruh Mekanisme Corporate Governance dan Struktur Kepemilikan terhadap Kinerja Keuangan”. 2, 1-10.Permanasari, Wien Ika. 2010. Pengaruh Kepemilikan Manajemen, Kepemilikan Institusional, dan Corporate Social Responsibility terhadap Nilai Perusahaan. Skripsi, Program Sarjana Akuntansi, Semarang: UNDIP.Purba, Eka Susiyanti. 2011. Analisis Pengaruh Good Corporate Governance terhadap Kinerja Keuangan Perusahaan Perbankan yang Terdaftar di Bursa Efek Indonesia. Skripsi, Program Studi Strata-1 Akuntansi, Medan: USU.Rofina, Maria., dan Maswar Patuh Priyadi. 2013. “Pengaruh Penerapan Good Corporate Governance terhadap Kinerja Keuangan Perusahaan DI BEI”. Jurnal Ilmu dan Riset Akuntansi 2(1).Sabrinna, Anindhita Ira. 2010. Pengaruh Corporate Governance dan Struktur Kepemilikan terhadap Kinerja Perusahaan. Skripsi, Program Sarjana Akuntansi, Semarang: UNDIP.Sukamulja, Sukmawati. 2004. Good Corporate Governance di Sektor Keuangan: Dampak GCG Terhadap Kinerja Perusahaan (Kasus di Bursa Efek Jakarta). BENEFIT, Vol.8, No. 1, h. 1-25.Sulistyowati., dan Fidiana. 2017. “Pengaruh Good Corporate Governance terhadap Kinerja Keuangan pada Perusahaan Perbankan”. Jurnal Ilmu dan Riset Akuntansi 6(1).